Making the move to a new state is a big decision. A decision that can come with excitement, questions, and a fresh start. If you’re looking for sunny skies, zero state income tax, and a laid-back lifestyle, it’s no wonder thousands of people choose to relocate to the Sunshine State each year. Learning how to become a Florida resident can help you take full advantage of everything this vibrant state has to offer.

But making Florida your new home involves more than unpacking boxes—it means taking the legal steps to establish residency. In this guide, we’ll walk you through exactly what it takes to claim Florida as your official state of residence and start enjoying all the benefits that come with it.

Establishing Florida Residency: What New Homeowners Should Know

What Does It Mean to Be a Florida Resident?

Becoming a Florida resident means that Florida is your primary and permanent home for both legal and tax purposes. This is also known as making it your domicile. Having this status as a Florida resident affects everything from your state income tax obligations (or lack thereof) to your voting eligibility, property ownership benefits, and college tuition rates.

Under Florida law, a person is considered a legal resident if they have the intent to make Florida their permanent home and have taken overt actions to demonstrate that intent. This is especially important for matters like: homestead exemption on property taxes, eligibility for in-state tuition, and estate planning and asset protection laws.

For income tax purposes, the IRS and many states might continue to treat you as a resident somewhere else unless you prove Florida is your primary residence and spend half your year in Florida. If you want to benefit from Florida’s lack of state income tax, it’s crucial to establish legal residency and end tax obligations in your former state.

Step-by-Step Guide to Become a Florida Resident

Just because you reside in Florida, it doesn’t mean you automatically become a Florida resident. It requires several key actions that demonstrate your intent to make the Sunshine State your permanent home. Here’s a step-by-step breakdown of what to do:

1. Secure a Florida Address

Without a Florida address, you won’t be able to update your license, register your vehicle, or file official documents that establish residency. So, the first and most important step in becoming a Florida resident is securing a permanent address in the state.

You have a few options to get a Florida address:

- Sign a lease on a rental property.

- Purchase a home (new or resale)

- Live with a family member or friend who can provide written proof that you reside at their address.

To prove your Florida address, you’ll need to keep documentation on hand. Accepted forms of proof include:

- A signed lease agreement

- A deed or mortgage statement

- A utility bill with your name and Florida address listed.

2. Get a Florida Driver’s License and Register Your Vehicle

Once you’ve secured a Florida address, your next step is to update your driver’s license and vehicle registration. Florida law requires new residents to complete both within 30 days of establishing residency.

Start by visiting your local Florida Highway Safety and Motor Vehicles (FLHSMV) office.

What to Bring:

To get a Florida driver’s license, you’ll need:

- Proof of identity (such as a valid passport or birth certificate)

- Proof of your Florida address (like a lease, deed, or utility bill)

- Your Social Security number (or a legal document with the number listed)

To register your vehicle in Florida, bring:

- Your current out-of-state title

- Proof of Florida auto insurance

- A completed HSMV Form 82040

It’s a good idea to complete both your license and vehicle registration on the same visit, if possible. Doing so helps solidify your Florida residency and ensures you stay compliant with state law.

3. Register to Vote in Florida (Optional but Recommended)

While registering to vote in Florida is not legally required to establish residency, it’s one of the clearest ways to demonstrate your intent to remain in the state, especially if you’re working to sever legal and tax ties with your previous home state.

By registering to vote, you establish civic ties and confirm your domicile status, which can be useful in matters related to taxes, insurance, and tuition. It also allows you to participate in local, state, and federal elections in Florida, helping you shape the future of your new community.

How to Register to Vote in Florida

You have a few convenient options:

- Online through the Florida Online Voter Registration System

- In person at your county’s Supervisor of Elections office

- While updating your driver’s license at the FLHSMV (most offices allow you to check the box and register on the spot)

Make sure to bring a valid Florida driver’s license or state ID and your Social Security number when registering in person. Once registered, you’ll receive a Voter Information Card in the mail confirming your eligibility.

Even if you’re not politically active, taking this step is a simple, proactive way to show that Florida is now your permanent home.

4. File a Declaration of Domicile

One of the most important legal steps in becoming a Florida resident is filing a Declaration of Domicile. This is a sworn affidavit that formally states your intent to make Florida your permanent, primary home.

Why It Matters

While actions like updating your driver’s license and registering to vote help demonstrate residency, the Declaration of Domicile is a clear legal statement of your intent, especially useful if you:

- Spend time in more than one state each year.

- Still own property out of state

- Want to reduce the risk of being taxed as a resident by your previous state

Filing this document can help solidify your position in residency disputes related to taxation, estate planning, and asset protection.

Where to File

You can file the Declaration of Domicile at the Clerk of the Circuit Court in the county where you reside. Most clerks offer downloadable forms on their websites, or you can complete the document in person.

You’ll typically need:

- A valid photo ID

- Your Florida address

- A notary public (often provided at the clerk’s office)

Once filed, the Declaration is recorded in the public records and becomes a part of your legal evidence of residency.

5. Update Your Financial and Legal Documents

To fully establish your Florida residency and reduce the risk of being considered a resident elsewhere, especially for tax and legal purposes, you’ll need to update your official records to reflect your new Florida address.

These updates not only strengthen your claim to Florida residency but also help ensure continuity in your financial and legal affairs.

Key Areas to Update:

- IRS Records

Submit IRS Form 8822 to officially change your address with the Internal Revenue Service. This is especially important for ensuring that your tax filings reflect Florida as your home state—critical if you’re trying to avoid income taxes from your previous state of residence. - Banking and Credit Card Accounts

Log in to your bank and credit card providers and change your primary billing address to your Florida residence. Some financial institutions may also ask you to confirm residency by submitting a utility bill or lease document. - Insurance Policies

Update all forms of insurance:- Auto insurance: Florida requires in-state coverage to register your vehicle.

- Homeowners or renters’ insurance: Reflect your Florida property.

- Health insurance: Ensure your policy covers in-network providers in Florida.

- Estate Planning Documents

If you’ve moved from out of state, your will, trusts, powers of attorney, and other legal documents may not fully comply with Florida law. Have them reviewed and updated by a Florida-based estate planning attorney to reflect your residency and address. - Professional Licenses or Business Registrations

If you hold professional licenses (medical, legal, real estate, etc.) or run a business, update your address with the appropriate state agencies or licensing boards. For business owners, this may include updating your registered agent address or filing a change with Sunbiz.org, Florida’s Division of Corporations.

Keeping your records consistent across all areas is a key step in demonstrating that Florida is your permanent home, especially if you’re leaving a high-tax state or plan to split time between multiple residences.

Common Mistakes to Avoid When Applying for Florida State Residency

Establishing Florida residency offers real financial and lifestyle benefits—but it also requires consistency and follow-through. Even small missteps can jeopardize your ability to claim Florida as your primary residence, especially if you’re coming from a state that aggressively pursues former residents for taxes.

Below are some of the most common mistakes new Florida residents make—and how to avoid them:

1. Retaining an Out-of-State Driver’s License or Address

Keeping your driver’s license, vehicle registration, or mailing address in another state is one of the biggest red flags It can suggest that you haven’t fully committed to Florida as your domicile, which can lead to:

- Conflicting records with tax or legal agencies

- Loss of Florida benefits, such as homestead exemption or in-state tuition

- Potential tax claims from your former state

Solution: Obtain your Florida driver’s license and register your vehicle within 30 days of moving. Update all personal accounts to reflect your new Florida address.

2. Not Spending Enough Time in Florida (183-Day Rule)

To be considered a tax resident of Florida, you should spend at least 183 days (about 6 months and 1 day) per calendar year physically in the state.

Failing to meet this threshold can result in your previous state attempting to tax your income, even after you’ve moved.

Solution: Keep a record of your time in Florida through travel logs, utility bills, or GPS-based phone apps. If you split your time between multiple homes, this step is especially critical.

3. Failing to File a Declaration of Domicile

The Declaration of Domicile is a simple but powerful legal tool to prove your intent to live in Florida permanently. Many people skip this step, assuming their driver’s license or home purchase is enough—only to face challenges if their residency is questioned later.

Solution: File your Declaration of Domicile at the Clerk of Court in your county shortly after moving. It strengthens your residency claim, especially for tax and legal purposes.

4. Keeping Inconsistent Financial or Voter Records

If your financial, legal, and civic records still point to another state, it undermines your Florida residency claim.

Examples include:

- Voting in your former state

- Keeping your old address as primary on bank accounts or tax returns

- Not updating insurance or professional licenses

Solution: Systematically update all accounts and documents to reflect your Florida residency. Register to vote in your Florida county (even though it’s optional) as a strong signal of your intent.

Establishing residency is about more than checking boxes—it’s about aligning your legal, physical, and financial life in one state. Avoid these common mistakes, and you’ll be well on your way to enjoying the full benefits of becoming a Florida resident.

How Long Does It Take to Become a Florida Resident?

Establishing Florida residency isn’t instant. But, with the right steps, it can happen faster than you might think. How long it takes depends on what kind of residency you’re aiming to establish (legal, tax, or for tuition/benefit purposes) and how quickly you take action to prove your intent.

How Long Does It Take to Become a Florida Resident?

Establishing Florida residency isn’t instant. But, with the right steps, it can happen faster than you might think. How long it takes depends on what kind of residency you’re aiming to establish (legal, tax, or for tuition/benefit purposes) and how quickly you take action to prove your intent.

The 183-Day Rule (For Tax Residency)

If you’re moving to Florida from a state that imposes income tax, you’ll want to establish Florida as your tax home. To do that, you must:

- Spend at least 183 days (more than half the year) physically present in Florida.

- These days don’t need to be consecutive, but they do need to be documented.

- States like New York and California often audit former residents, so it’s critical to keep receipts, utility bills, travel logs, or GPS-based app data to prove where you’ve been.

This rule is especially important if you’re trying to break residency ties with your previous state to avoid dual taxation.

Timelines for Updating Legal Documents

Aside from physical presence, you’ll need to complete key residency actions quickly after your move:

- Driver’s License & Vehicle Registration – Required within 30 days of establishing residency.

- Declaration of Domicile – Can be filed as soon as you arrive and secure a Florida address.

- Voter Registration & Mailing Address Updates – Should be handled promptly to reinforce intent.

- Financial and Legal Documents – Update as soon as possible to ensure consistency across your accounts.

Completing all these steps within your first 30–60 days in Florida helps clearly demonstrate your intent to remain and supports any future claims to Florida residency.

Considering Building or Buying a Home?

Your timeline may also depend on your housing situation. If you’re planning to relocate permanently, purchasing or building a home in Florida gives you a legal address and can signal strong long-term intent to stay.

We at Deltona have been building in Florida since 1962 and offer move-in-ready homes and build-on-your-lot options in various cities. Consider whether it’s better to build or buy a home in Florida based on your lifestyle, timeline, and long-term goals.

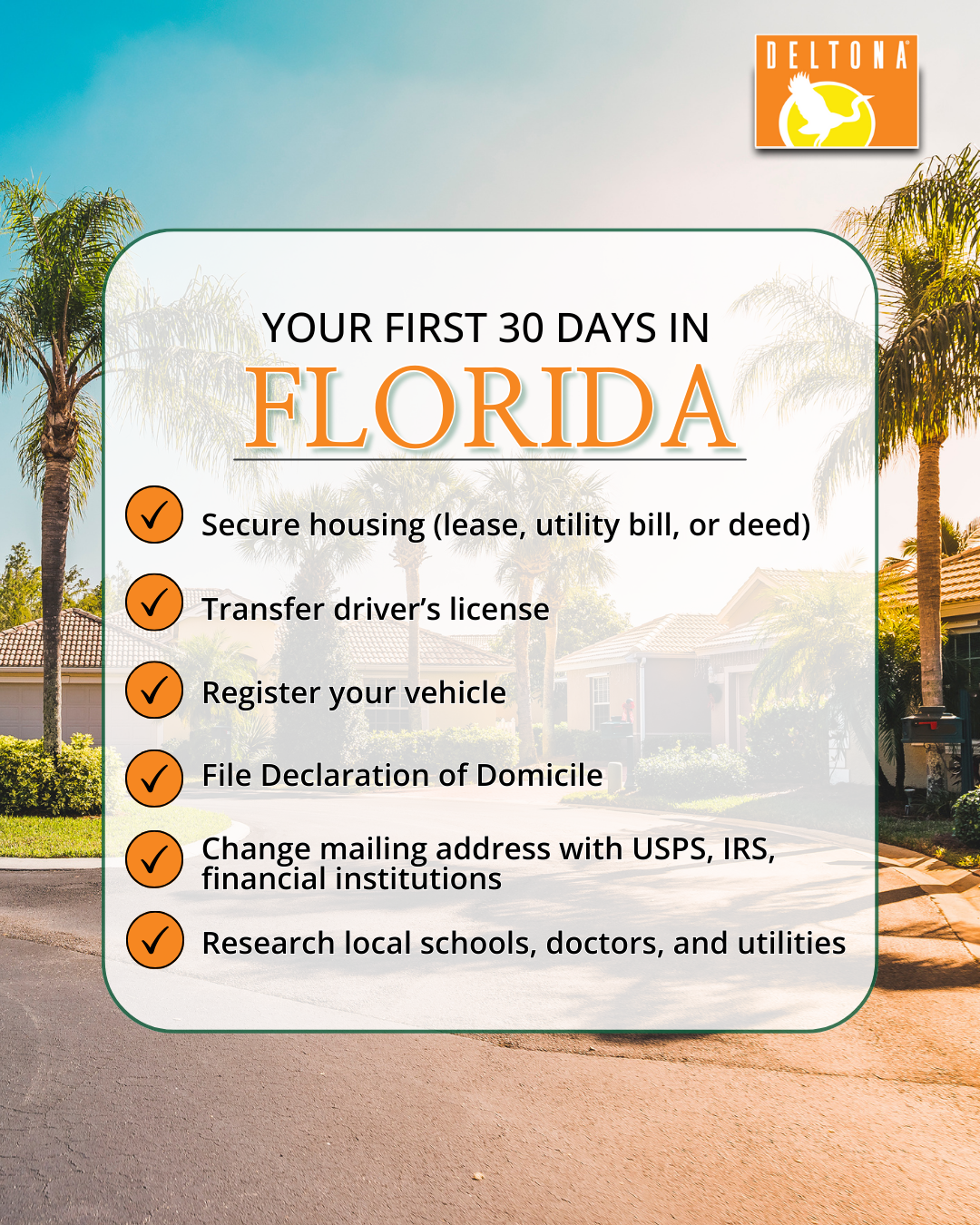

Checklist For Your First 30 Days

Establishing Florida Residency FAQ

How Long Does It Take to Establish Florida Residency?

It depends. Some steps, like getting a Florida driver’s license or filing a Declaration of Domicile, can be done immediately. However, establishing full residency, especially for tax purposes, will take up to 6 months, as you’ll need to spend at least 183 days in Florida and align your documents, address, and intent across legal and financial records. How quickly you act and how well you document your move can significantly affect your timeline.

How do I get a Florida ID Card?

If you don’t drive or prefer not to transfer your out-of-state driver’s license, you can apply for a Florida identification card through Florida Highway Safety and Motor Vehicles (FLHSMV).

To apply:

- Visit a local FLHSMV office.

- Bring documentation showing proof of identity, Social Security number, and two documents proving a Florida residential address.

- Pay a small processing fee.

Florida ID cards look similar to driver’s licenses and serve as valid identification for most legal and financial purposes.

What is a Florida Residency Declaration Form?

A Florida Residency Declaration Form is another name for the Florida Declaration of Domicile, which is a sworn legal statement that confirms your intent to make Florida your permanent and primary residence. This form is especially useful if you own property in another state or divide your time between locations.

To file:

- Visit your county’s Clerk of Court office.

- Complete the form and have it notarized.

- Pay a filing fee (usually $10–20).

- The declaration is then recorded in the county’s public records.

Filing this form strengthens your residency claim and is often used in tax, legal, and estate matters to prove Florida is your domicile.

Can I have a Florida driver’s license with an out-of-state address?

No. Florida law requires that your driver’s license reflects your current, in-state residential address.

Having a Florida license with an out-of-state address can raise red flags and may disqualify you from benefits like:

- Homestead exemption

- In-state college tuition

- Tax residency recognition.

Once you establish a Florida residency, you must apply for a Florida license within 30 days and ensure your address is current.

H4: Can I live in Florida and have a car registered in another state?

Technically, you can own a car registered elsewhere, but you cannot legally reside in Florida full-time and operate an out-of-state registered vehicle. Florida requires new residents to:

- Register their vehicle in Florida within 10 days of:

- Gaining employment

- Enrolling children in school

- Establishing a residence (buying or leasing a home)

Failure to do so may result in penalties, and it could interfere with your ability to prove Florida residency for tax or legal purposes.

To stay compliant and strengthen your residency claim, it’s best to:

- Obtain Florida insurance coverage.

- Transfer your vehicle registration and title.

- Update your driver’s license at the same time.

Ready to Become a Florida Resident?

From zero state income tax to year-round sunshine and a slower, more enjoyable pace of life, Florida residency offers tax benefits and lifestyle advantages that you’ll love!

By taking the right legal and logistical steps, avoiding common pitfalls, and making your intent to stay clear, you can confidently call the Sunshine State home and enjoy all that Florida has to offer. At Deltona, we’ve been helping individuals and families plant roots in Florida since 1962. With thoughtfully planned neighborhoods and a variety of new home options, we’re here to help you start your next chapter with confidence.

Explore our communities, tour a model home, and let us help you find the right place to begin your Florida story

Recent Comments